The global soldering equipment market is undergoing a significant transformation as electronics manufacturing becomes faster, smarter, and more precise. From EV power systems to ultra-compact consumer wearables, the need for reliable joining technology has never been greater. As a long-standing manufacturer in this space, Bakutool has had a front-row seat to how customer expectations, regulatory frameworks, and engineering challenges are reshaping demand. In this blog, we explore the market’s key trends and growth drivers — along with Baku’s insider view on where the industry is heading next.

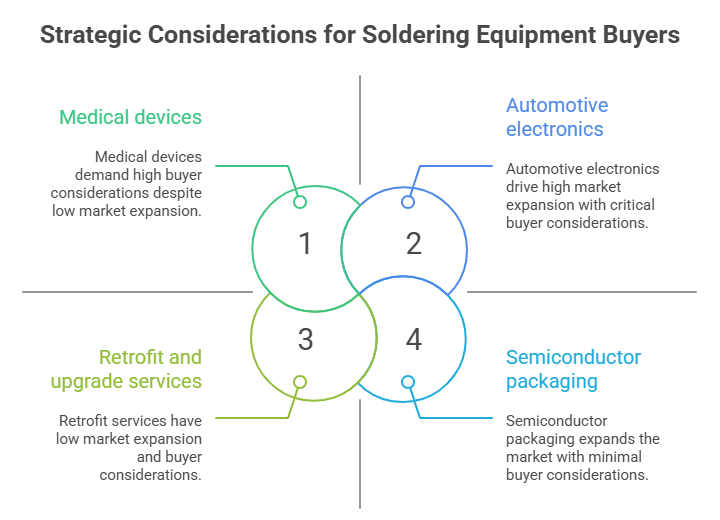

Demand for soldering equipment is primarily driven by the electronics industry — consumer devices, automotive electronics (especially EV-related electronics), telecommunications infrastructure (5G rollout), industrial automation, medical devices, and renewable energy electronics. Miniaturization of PCBs, the rise of surface-mount technology (SMT), and tighter quality and reliability standards push manufacturers to invest in more precise, repeatable soldering solutions. In parallel, growth in contract electronics manufacturing (CEM/EMS) and IoT device proliferation create steady volume demand for both bench-top tools and high-throughput production systems.

Automation is the clearest and most impactful trend. Manual soldering still exists for prototyping, repairs, and specialty applications, but production lines increasingly rely on automated soldering systems: selective soldering machines, wave soldering, and precision robotic soldering cells. Smart features — AI-driven process optimization, machine vision for joint inspection, data logging for traceability, and closed-loop temperature control — are becoming standard in higher-end equipment. These features reduce defects and rework, and they enable predictive maintenance, which lowers downtime and operating costs.

As components shrink (think micro-BGA, µSMDs, and flexible PCBs), soldering systems must handle finer pitches and tighter thermal profiles. Precision thermal control, very small soldering tips, and micro-dispensing for solder paste and flux are in demand. This creates a market segment for specialty micro-soldering stations and precision reflow ovens designed for sensitive assemblies like wearables, medical implants, and advanced sensors.

Soldering equipment manufacturers face pressure to reduce energy consumption and environmental impact. Newer reflow ovens, hot air stations, and selective soldering units focus on improved insulation, faster thermal recovery, and more efficient heaters. Fluxless soldering technologies, lead-free solder compatibility, and systems designed to minimize fumes and waste (with better fume extraction and recycle-friendly consumables) are rising in importance due to regulatory and customer demands.

Regulatory frameworks (RoHS, WEEE) and customer requirements pushed the industry away from traditional tin-lead solders. Lead-free alloys — typically SAC (tin-silver-copper) formulations — have higher melting points and different thermal characteristics, which forced equipment redesigns for reliable processing. In parallel, niche high-reliability alloys (low-melting, high-conductivity, or specialized solders for extreme environments) are a growth area in aerospace, automotive, and medical applications.

Traceability is now expected in many industries. Soldering equipment increasingly offers data capture (temperature profiles, nozzle usage, cycle counts), user-access controls, and exportable logs to satisfy quality systems (ISO, IPC standards). Integration with MES (Manufacturing Execution Systems) and Industry 4.0 platforms allows real-time monitoring and analytics, increasing yield and helping with root-cause analysis of defects. This digital layer also supports remote diagnostics and firmware updates — reducing service costs.

Buyers are looking for equipment that is modular and easy to service — swappable heads, standardized controllers, and upgrade paths so capital equipment can adapt to evolving product lines. Consumables (tips, heaters, flux cartridges, nozzles) represent recurring revenue for vendors, so manufacturers compete on both component quality and total cost of ownership. Training and after-sales support are differentiators for suppliers serving complex sectors like automotive and medical.

Asia-Pacific remains the largest regional market, driven by a dense electronics manufacturing ecosystem in China, Taiwan, South Korea, Japan, Vietnam, and increasingly India. North America and Europe show steady demand for high-end, automated systems focused on high-reliability sectors (automotive, aerospace, defense, medical). Emerging markets in Southeast Asia and Latin America are growing as companies diversify supply chains, increasing demand for both entry-level and mid-tier equipment.

Several factors can slow growth: cyclical fluctuations in consumer electronics, trade tensions affecting supply chains, and raw material price volatility (e.g., for copper and specialty alloys). Also, adoption of alternative joining technologies — such as conductive adhesives, laser soldering, or welding for certain applications — could erode some traditional soldering segments over time. Labor shortages, especially skilled soldering technicians, are another constraint pushing firms toward automation.

The soldering equipment market is evolving quickly, shaped by automation, miniaturization, digitalization, and environmental responsibility. As a manufacturer deeply embedded in this industry, Baku is committed to developing tools that reflect these realities — delivering the precision, reliability, and intelligence that modern electronics production requires. Whether it’s advanced rework systems for professional lines or durable, user-friendly tools for repair and prototyping, Baku continues to focus on building solutions that help customers stay ahead of the industry curve.